On This Page:

- What is a Cash Discount Program?

- What is the Difference Between Surcharge and a Cash Discount Program?

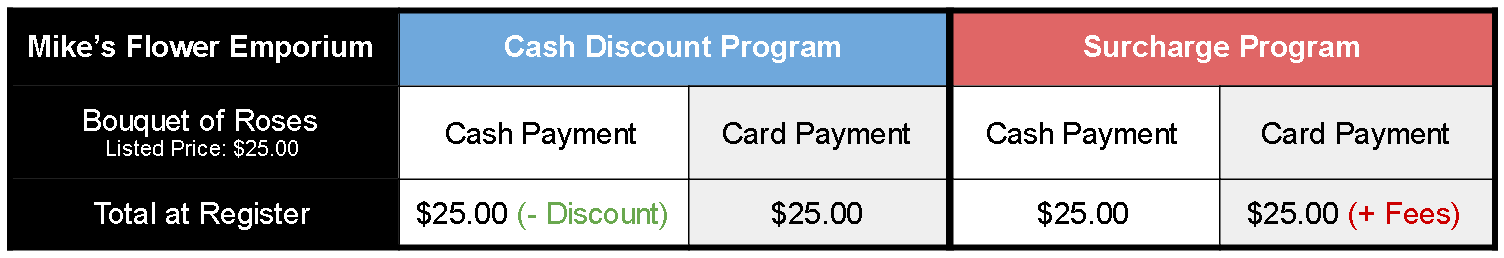

- Example of Cash Discount VS Surcharge

- Chart Example of Differences

- Merchant Benefits of Cash Discount Program

- Required Cash Discount Signage

- Is A Cash Discount Program Right For Your Business?

- Do You Want to Accept More Cash Payments?

- Signing Up For A Cash Discount Program

Credit card processing, as a whole, has continued to be an increasingly costly business expense that many merchants are seeking to alleviate. One of the most effective ways merchants have been able to significantly reduce their processing fees is by joining a Cash Discount Program. This type of program incentivizes their customers to pay via cash or check, thereby counteracting any payment processing fees the business owner may normally pay.

What is a Cash Discount Program?

Basically, merchants using a cash discount program are able to offer a discount to their customers who choose to make a purchase using cash or a check, rather than a debit or credit card.

This incentive is done by offering a discount on the posted credit or debit price of products if they choose to use cash or check instead. However, if the customer still chooses to use a debit or credit card to complete the transaction, then they will see a service fee included in their total which offsets the merchant’s normal payment processing fees.

Many merchant’s get Cash Discount Programs confused with a surcharge or a surcharge program. This is not a surcharge and is legal in all 50 states. Let us explain in more detail…

What is the Difference Between Surcharge and a Cash Discount Program?

While vaguely similar in their results, there are significant differences that separate surcharges and cash discounts. A surcharge is when a merchant tacks on additional fees to the posted prices of products if a customer pays with a debit or credit card. A cash discount is when a merchant is able to offer a discount to the posted price of products when a customer uses cash or check to pay.

With a cash discount program, cash customers get a discount and card customers will simply pay the listed prices. For a surcharge, only cash customers get the listed prices and card customers pay even more on top of the listed prices.

Example of Cash Discount VS Surcharge:

Mike’s Flower Emporium has a bouquet of roses listed on the shelf for $25.00. If you offer a cash discount, a cash customer would pay less than $25.00 and a card customer would pay the shelf price of $25.00. On the other hand, with a surcharge, a cash customer would pay the shelf price of $25.00 and a card customer would be paying above $25.00 with fees added on.

While, on the surface, these two programs may seem to basically accomplish the same thing, they are incredibly different in their implementation. This difference is vitally important when it comes to complying to laws and regulations and avoid fines or a merchant account closure. For example, cash discount programs are legal in all 50 states, while surcharging is strictly prohibited by law in eleven states.

Merchant Benefits of Cash Discount Program

Lower Your Payment Processing Fees

The first and probably the most apparent benefit that merchants enjoy when they switch to a cash discount program is a dramatic reduction or even complete elimination of their card processing fees. With less card transactions to process, the fees to accept those card payments will reduce as well.

Access to Faster Funds

Although many customers tend to pay with cards, offering a cash discount encourages more customers to pay with cash instead. With an increase in cash, you avoid any processing fees and have instant access to funds. On top of this, by accepting more cash payments, you greatly reduce the chances for fraud.

Reduce Your Chargebacks

Adding to the benefits of increasing your cash payments, with the reduction in card payments, your chargebacks will decrease as well. Chargebacks are incredibly harmful to your merchant account and can result in held funds or even account closures.

Incentivizing Customers with A Discount

Just like offering a tantalizing sale on products, giving customers an additional discount when paying with cash gives them a satisfying feeling of saving money. Although the savings customers receive when you offer a cash discount is not huge, it still has the same effect of drawing customers in and increasing total purchases.

Required Cash Discount Signage

When a merchant chooses to adopt a cash discount program, they are required to clearly post signage to inform customers of the discount they will receive if they pay with cash instead of a card. This requirement is set in place by the credit card brands and is mandatory to stay full compliant.

Initial signage is provided by your merchant service provider and it is up to you to post them prominently for customers to see during checkout. Verbage of the signs briefly explains the discount amount that customers receive when paying with cash.

How to Implement A Cash Discount Program

Beyond the required signage, there are other rules that must be followed. Receipts must properly show a service charge on products when a card is used during purchase and, conversely, must also show a service charge being removed if the customer uses cash instead.

This may sound complicated to implement, but luckily, all of this is programmed into your terminal and done automatically by your credit card processor. Your merchant service provider can help you stay compliant, provide proper signage and implement cash discount terminals.

Is A Cash Discount Program Right For Your Business?

Now that we’ve covered the basics of how a cash discount works and the benefits, it’s important to consider if a cash discount program is a good option for your business.

Do You Want to Accept More Cash Payments?

Offering a cash discount during checkout is not guaranteed to sway everyone into not using a card, however, you will see an increase of cash based transactions overall. This does cut down on the potential for fraud, chargebacks and gives you instant access to disposable business funds. But, if for some reason having more cash on hand is not beneficial to your business, you should keep that in mind.

Signing Up For A Cash Discount Program

Leap Payments has been providing valuable merchant services to businesses across the US for over 10 years. From supporting high risk merchants that get turned down by other processors, to offering new cost efficient programs like cash discount, we pride ourselves in putting our merchant’s satisfaction first. We provide all of our merchants with the best in payment processing and customer support, 24/7, 365 days a year.

If you’re ready to boost sales, drastically reduce your monthly card processing fees and receive top tier customer service around the clock, Leap Payments’ Cash Discount Program is just for you. Give us a call at (800) 993-6300 or fill out the form below and our cash discount representative will guide you through the entire application process.