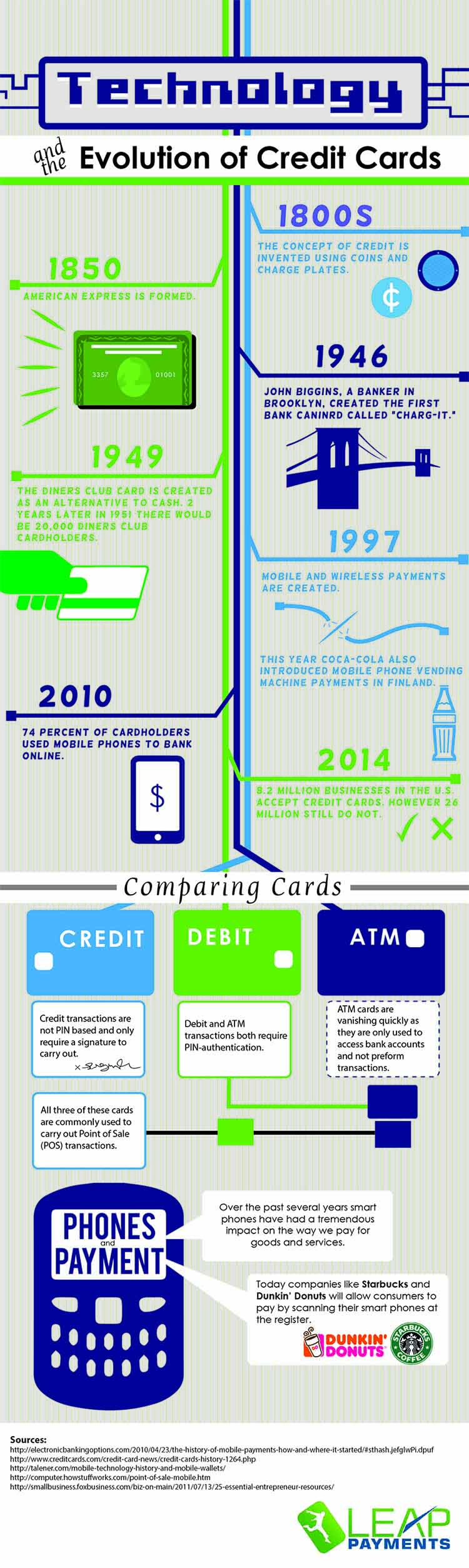

Payments over the Years

For as long as products and services have been available, customers have been paying for them in one way or another. Although these services have always been paid for, how they’ve been compensated has greatly changed over the years.

Cash

Cash has always been an option when paying for goods. In the past, people might have paid for food or services in gold, silver or copper coins. Currently, dollar bills and coins are used in the United States.

Barter – Trades

Trading services is a payment option that has been around for many years. In the past, a person without a cow might trade a dozen eggs for a gallon of milk. Although we might not see that type of trading presently, you can usually see companies and individuals trading services.

Debit

Direct withdrawals from checking accounts via the debit networks, no credit card required. Also used

Credit

Credit is another way people have paid for goods and services. At one time, general stores kept track of a person’s line of credit. A customer could purchase items over the course of a few days or weeks and then pay for the purchases all at once. This concept has transformed over time and is currently seen in the form of credit cards. Instead of general stores tracking the line of credit, credit card companies approve customers for a certain amount of money. Monthly payments are made on any purchases or existing balances.

Prepaid –

Typically used by the unbanked or people without a bank account, they can use a debit card to add funds and subtract funds from a debit card, or a stored value accounts.

Bitcoin?

Is a digital currency and is usually sent to people over the internet. There are many advantages to this type of currency you don’t have to go through a bank, fees are lower, no frozen accounts or limits and you can use them worldwide.