Credit Repair

Merchant Accounts

At Leap Payments our goal is to make sure that your business can process credit cards. We can support industries considered by some to be high risk with domestic and even off shore solutions, so your business can accept credit cards.

Credit Repair Merchant Accounts

As a credit repair service, you are in the business of giving people a second chance at financing their dreams. Since the recession of 2008, people have had to rebrand themselves by learning new skills, taking second and third jobs, and accessing multiple revenue streams. However, even though the economy is improving, many people are still having difficulties with new purchases, that they should be able to afford, are out of their reach due to lingering bad credit resulting from previous financial difficulties. This is why the credit repair industry is so important.

Unfortunately, as you are well aware, helping people improve their credit scores can be a risky endeavor. While you do your best to vet each client you take on, there is always the risk that the thing which earned a person a poor credit rating in the first place may can cause them to default on payments again.

To make things worse, the financial industry, as a whole, looks at credit repair businesses and only sees risk. Payment processors work with banks to place their accounts and get their merchants a processing account. The issue with credit repair is the fact that most banks will not touch this industry.

For these reasons, many credit processing companies are reluctant to accept your application for a credit repair merchant account. First, they will put you through a lengthy application process, which often comes with a processing fee. Then you have to wait, sometimes weeks, and there’s no guarantee you’ll be accepted.

Increase Business with a Credit Repair Merchant Account

The credit repair industry has seen huge growth in the last several years. This is due to the overwhelming need by customers to boost their scores for life events ranging from car and house loans and even applying to jobs. Having the ability to collect on payments is arguably one the most important parts of a credit repair business. Despite this fact, getting a credit repair credit card processing merchant account can often prove difficult.

Overcoming the Difficulties of the Industry

Because people always demand such fast results that are often not realistically possible, extremely high chargeback rates are common within the industry. Many traditional banks see credit repair as an undesirable venture due to high risk and high volume. This is especially true for startup companies. Here at Leap Payments, we don’t care about that. Don’t get turned away without a realistic chance of applying for a merchant account at a less experienced processing provider.

Applying for a Credit Repair Merchant Services Account

Because credit repair is considered to be a high-risk business, the application process will be a bit more complex than other industries would be. You can apply for a credit repair merchant account today. But be warned, if you go with a generic, non-high risk merchant account providers, the process can be even longer with extreme limitations, spotty service or even just a flat out decline.

You’ll be asked to fill out an application, which can be quite lengthy at other merchant account providers, and submit the following documents:

- Your government-issued ID

- A bank letter or voided check

- Three months of recent bank statements

- Three months of processing statements

- Your Social Security Number or Employer Identification Number

- And you must have a chargeback ratio under 2%

If you are one of the many new credit repair merchants, you might not have three months of processing statements to turn over. If you’re an especially small business with no employees you may not know your Employer Identification Number. In some cases, you may not even have one. Do not worry, our credit repair merchant account representatives can walk you through exactly what you need and answer any questions you may have. Call us at (800) 993-6300.

After you’ve collected all of these items, the credit processing services provider will run your application by their banks underwriters, who has the actual, final decision on your accounts approval. This can take quite a while, especially with some of the larger, generic payment processors.

Here at Leap Payments, we do our best to make the application process fast and easy. We will guide you through it, and in most cases, we will tell you whether or not your application is accepted within 24 hours. While we cannot guarantee acceptance, we can tell you that our acceptance rate is far higher than any of the other credit processing services out there.

What Application Processors Look for

To get your credit repair credit card processing business up and running at maximum profitability, having the ability to accept debit and credit card payments. Just because most banks and processors classify credit repair businesses as high risk doesn’t mean they should be barred from having the same opportunity to process credit cards as any other company does. Because the finance industry considers you to be high risk, you need the best high risk merchant service provider. We want to help any way we can. So here are a few helpful tips when you’re preparing to apply.

Stay Compliant.

Be sure to always follow any rules that apply to credit repair businesses. Bank underwriters will examine your payment processing history for any red flags. If you are uncertain what is legal or what are considered best practices, consult with one of our high risk merchant account representatives before making a decision.

Good Credit Score.

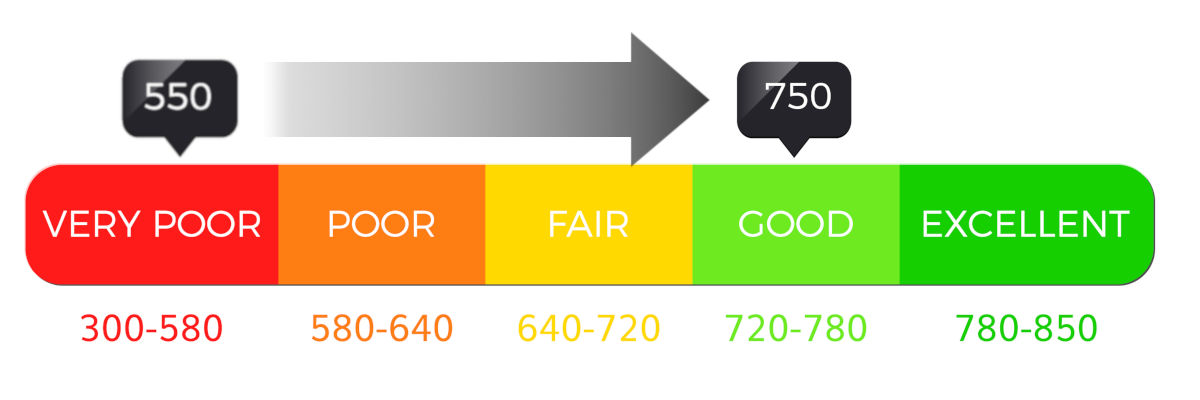

Your credit score will affect your approval odds when applying for a high risk merchant account. But as a credit repair business, making sure your own credit score is even more important. It can look suspicious to bank underwriters if it seems like you should be utilizing your own services. Another warning sign that could get your application rejected is a heavy history of chargebacks. That is true for any kind of merchant. You should also avoid any unnecessary risks. As a credit repair service, taking needless risks is another red flag in the eyes if processors and underwriters.

Reduce Outstanding Debt.

If you have large loans or significant outstanding debt, now is a great time to try and reduce that. Underwriters do not like to see a lot of outstanding debt. Pay as much of it down as possible. In a perfect world, paying all of it off would be the best strategy.

If you are proactive, follow best practices and partner with the best high risk credit card processor, there’s no reason you can’t get reliable, quality merchant services.

As you can see, the process can be pretty involved. That’s why we work closely with applicants to make the application process as easy as possible and to give you the best chance of being approved.

Make Leap Payments Your First Choice in Providers

Leap Payments knows how the credit repair industry works and how to best build a system that works for your business’s needs. Many credit repair companies open merchant account with Leap Payments for these reasons and many more:

- Lock in Lifetime Rate Guarantee

- Custom Online Processing Solutions

- Terminal & POS Integration

- Instant, Same Day or Next Day Funding*

- Always 100% U.S.-Based Support

- Online Credit Repair Payment Gateways

*Next day funding is not guaranteed for all merchant accounts. Available only for qualifying merchants. To see if you qualify, call (800) 993-6300 now and speak to an account specialist.

With a customer support team that is 100% U.S. based, we are always ready and eager to help you anytime, whenever you need. We can assist account questions, give advice on the best credit card readers and even show you how to set up your credit card processing account. Contact a Leap Payments Credit Repair Account Specialist today.

Contact Us Below & Secure Your Lifetime Rate Lock Today!

Or Call: 800-993-6300